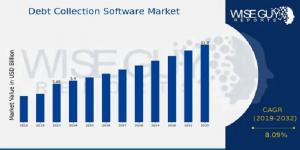

Debt Collection Software Market CAGR to be at 8.09% By 2032 | Automating Debt Collection for Better Efficiency

Debt Collection Software Market exhibits varying trends, growth patterns across different regions, regulatory compliance requirement, technological advancements

The debt collection software market has experienced significant growth in recent years, driven by the increasing need for efficient and automated solutions in managing overdue payments and optimizing recovery processes. With the rise in financial transactions, businesses and financial institutions are adopting advanced digital tools to enhance debt recovery strategies, minimize manual efforts, and ensure regulatory compliance. The growing demand for cloud-based solutions, artificial intelligence (AI)-driven analytics, and automation in debt collection is further fueling market expansion. Moreover, the integration of predictive analytics, machine learning, and omnichannel communication is enhancing debt collection efficiency, reducing operational costs, and improving customer interactions. As businesses seek to mitigate financial risks and streamline receivables management, the adoption of debt collection software is poised to witness robust growth across various sectors, including banking, healthcare, retail, and government agencies.

Get An Exclusive Sample of the Research Report at -

https://www.wiseguyreports.com/sample-request?id=645925

The debt collection software market is segmented based on component, deployment mode, organization size, and industry vertical. In terms of components, the market includes software solutions and services such as consulting, support, and maintenance. Deployment modes are classified into cloud-based and on-premise solutions, with cloud-based platforms gaining traction due to their scalability, cost-effectiveness, and remote accessibility. Additionally, organizations of all sizes, including small and medium enterprises (SMEs) and large enterprises, are leveraging debt collection software to automate workflows, enhance compliance, and improve debt recovery rates. The industry verticals adopting these solutions span banking, financial services, insurance (BFSI), telecommunications, healthcare, government, retail, and others, reflecting the widespread need for efficient debt management tools across multiple domains.

Market dynamics in the debt collection software industry are influenced by various factors, including technological advancements, regulatory frameworks, and evolving customer expectations. The increasing burden of bad debts and the need for organizations to comply with stringent regulations have heightened the demand for sophisticated debt collection tools. Automation, data-driven insights, and AI-powered decision-making are transforming traditional debt recovery processes, making them more efficient and customer-friendly. However, challenges such as data security concerns, integration complexities, and compliance with diverse regulatory standards remain significant hurdles for market growth. Additionally, economic fluctuations and changing consumer behaviors impact debt repayment patterns, further shaping the landscape of debt collection strategies and software adoption.

Buy Latest Edition of Market Study Now -

https://www.wiseguyreports.com/checkout?currency=one_user-USD&report_id=645925

Recent developments in the debt collection software market highlight a shift toward automation, AI-driven analytics, and customer-centric approaches. Companies are integrating conversational AI, chatbots, and self-service portals to enhance communication between debtors and creditors. The adoption of cloud-based debt collection solutions has surged, providing businesses with flexibility, scalability, and real-time data access. Strategic collaborations and mergers among key players are also driving market growth, enabling firms to expand their technological capabilities and market reach. Regulatory compliance remains a key focus, with organizations investing in solutions that ensure adherence to legal requirements and data protection policies. As digital transformation accelerates, debt collection software providers continue to innovate, offering advanced features such as predictive analytics, automated payment reminders, and customized collection strategies tailored to individual debtor profiles.

Key Companies in the Debt Collection Software Market Include:

• TransUnion

• CollectionMax

• CollectTech

• CCS Collections

• Tally Solutions

• Cognizant

• FICO

• Experian

• Dun and Bradstreet

• Mercury Data

• Oracle

• Clarifi

• SharpSpring

• MicroBilt

• Lawgical

Browse In-depth Market Research Report -

https://www.wiseguyreports.com/reports/debt-collection-software-market

The debt collection software market exhibits varying trends and growth patterns across different regions, with North America leading in adoption due to the strong presence of financial institutions, regulatory compliance requirements, and technological advancements. The United States, in particular, is a key contributor to market expansion, with enterprises focusing on AI-powered automation and data-driven insights to optimize collection processes. Europe follows closely, with stringent debt recovery regulations and increasing adoption of cloud-based debt collection solutions driving market growth. Countries such as the United Kingdom, Germany, and France are witnessing rising demand for automated debt management tools to enhance operational efficiency and customer engagement.

The Asia-Pacific region is emerging as a lucrative market, driven by rapid digitalization, growing fintech adoption, and an expanding financial sector. Countries like China, India, and Japan are investing heavily in debt collection technologies to address rising delinquency rates and improve financial stability. Meanwhile, Latin America, the Middle East, and Africa are gradually embracing debt collection software, with increasing awareness and regulatory frameworks promoting market expansion. As organizations across the globe prioritize efficient debt recovery strategies, the debt collection software market is expected to witness sustained growth, driven by continuous technological innovations and evolving customer expectations.

Check Out More Related Insights:

Content Moderation Service Market -

https://www.wiseguyreports.com/reports/content-moderation-service-market

Pipeline Intelligent Pigging Market -

https://www.wiseguyreports.com/reports/pipeline-intelligent-pigging-market

Multi Factor Authentication Software Market -

https://www.wiseguyreports.com/reports/multi-factor-authentication-software-market

Intelligent Building Automation Technologies Market -

https://www.wiseguyreports.com/reports/intelligent-building-automation-technologies-market

Political Campaign Software Market -

https://www.wiseguyreports.com/reports/political-campaign-software-market

Digital Customer Onboarding Software Market

Alternative Finance Market

About US:

Wise Guy Reports is pleased to introduce itself as a leading provider of insightful market research solutions that adapt to the ever-changing demands of businesses around the globe. By offering comprehensive market intelligence, our company enables corporate organizations to make informed choices, drive growth, and stay ahead in competitive markets.

We have a team of experts who blend industry knowledge and cutting-edge research methodologies to provide excellent insights across various sectors. Whether exploring new market opportunities, appraising consumer behavior, or evaluating competitive landscapes, we offer bespoke research solutions for your specific objectives.

At Wise Guy Reports, accuracy, reliability, and timeliness are our main priorities when preparing our deliverables. We want our clients to have information that can be used to act upon their strategic initiatives. We, therefore, aim to be your trustworthy partner within dynamic business settings through excellence and innovation.

Contact US:

WISEGUY RESEARCH CONSULTANTS PVT LTD

Office No. 528, Amanora Chambers Pune - 411028

Sales :+162 825 80070 (US) | +44 203 500 2763 (UK)

Mail :info@wiseguyreports.com

Sachin Salunkhe

WISEGUY RESEARCH CONSULTANTS PVT LTD

+1 628-258-0070

email us here

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release