Reconciliation Software Market to USD 6.5 Billion by 2032, Owing to Increasing Demand for Automated Financial Processes

Reconciliation software is gaining traction as businesses seek efficient, accurate, and automated solutions for financial processes and compliance.

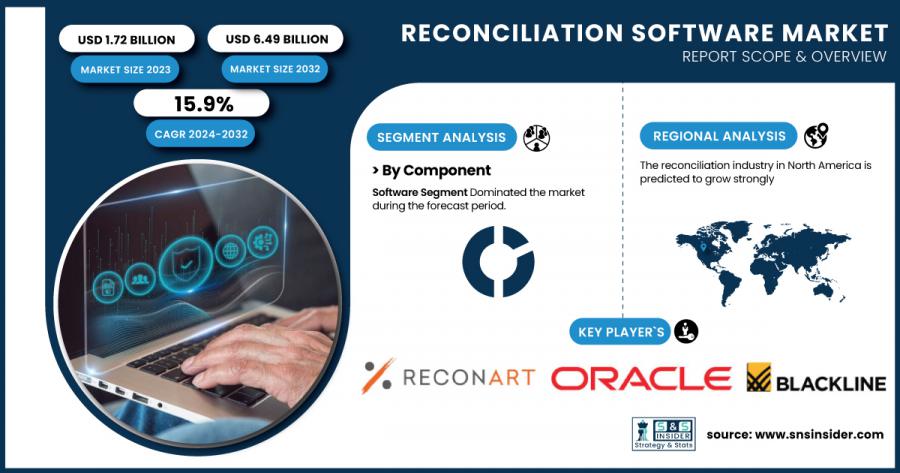

AUSTIN, TX, UNITED STATES, February 5, 2025 /EINPresswire.com/ -- The SNS Insider report indicates that the Reconciliation Software Market size was valued at USD 1.7 billion in 2023 and is expected to grow to USD 6.5 billion by 2032, growing at a CAGR of 15.9% over the forecast period from 2024 to 2032.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/2807

Keyplayers:

ReconArt Inc., Oracle Corporation, BlackLine Inc., Broadridge Financial Solutions, Inc., SolveXia, Tata Consultancy Services Limited, Xero Limited, SmartStream Technologies Ltd., Gresham Technologies plc, DUCO, StatementMatching.com Limited, SAP SE, Fiserv Inc.

Reconciliation Software Market Growth: Enhancing Financial Efficiency, Accuracy, and Compliance in a Digital Era

The reconciliation software market is seeing rapid growth as companies across various industries are focusing on improving the efficiency of their financial operations. This software provides automated reconciliation of bank statements, financial transactions, and other critical data, reducing the risk of errors and fraud. It enables companies to streamline operations, improve accuracy, and ensure regulatory compliance. Additionally, with the rise of digital finance, increased reliance on data-driven decision-making, and a focus on minimizing operational risks, reconciliation software is becoming a vital tool for organizations. Furthermore, as organizations continue to expand their operations globally, the need for real-time financial reporting and accurate reconciliation solutions is expected to propel the growth of this market.

By Component: Software Segment Dominated the Market, Services Segment Registers the Fastest CAGR

The software segment holds the dominant share in the reconciliation software market due to the increasing adoption of automated tools to simplify financial reconciliations. Businesses are turning to specialized software solutions that offer features such as transaction matching, real-time updates, and reporting capabilities. These tools help finance teams improve operational efficiency and reduce manual errors, making them an essential part of financial management.

The services segment, which includes cloud-based services, installation, training, and technical support, is growing rapidly. As businesses increasingly adopt reconciliation software, there is a rising demand for related services that ensure smooth integration, customization, and ongoing support. Service providers are offering tailored solutions to meet the diverse needs of organizations, which is contributing to the segment's rapid growth.

By Enterprise Size: Large Enterprises Segment Dominated the Market, Small & Medium Enterprises (SMEs) Registers the Fastest CAGR

Large enterprises continue to dominate the reconciliation software market due to their complex financial operations, large transaction volumes, and a higher need for automated solutions. These organizations often have the resources to invest in advanced reconciliation software, which helps them streamline processes, ensure compliance, and reduce risks.

SMEs are experiencing the fastest growth in the reconciliation software market as they increasingly recognize the value of automation in financial reconciliation. Affordable software solutions and cloud-based options have made these tools accessible to smaller organizations. With automation reducing manual effort, SMEs can improve accuracy and compliance, making it an attractive option for businesses with limited financial management resources.

Enquiry Before Buy: https://www.snsinsider.com/enquiry/2807

By Deployment: Cloud Segment Dominated the Market, On-premise Segment Registers the Fastest CAGR

The cloud deployment segment is leading the reconciliation software market due to its cost-effectiveness, scalability, and ease of implementation. Cloud-based reconciliation software offers businesses the flexibility to access their financial data from anywhere, which is essential for modern financial operations. The growing preference for cloud computing across industries has propelled this segment’s dominance, offering robust features with fewer upfront costs.

The on-premise deployment segment is growing at the fastest rate as certain businesses prefer to maintain full control over their reconciliation systems. On-premise solutions offer higher levels of security, customization, and integration with existing IT infrastructures, which appeals to industries with stringent data protection requirements.

Key Regional Developments: North America Dominates the Market, Asia-Pacific Registers the Fastest CAGR

North America holds the largest share in the reconciliation software market, driven by the presence of key players like BlackLine, Trintech, and ReconArt, as well as high adoption rates of advanced financial technology. The increasing demand for automated reconciliation tools across various industries such as banking, healthcare, and retail has contributed to the region's dominance.

The Asia-Pacific region is seeing the fastest growth in the reconciliation software market due to the increasing digitalization of financial services, the expansion of businesses, and the rising need for automation. Countries like China, India, and Japan are experiencing rapid economic growth, driving demand for efficient financial management solutions. The increasing number of small and medium-sized enterprises in these countries, along with greater awareness about the benefits of reconciliation software, is expected to fuel the market's expansion in the region.

Recent Developments in the Reconciliation Software Market in 2024

In January, BlackLine introduced new AI-based features in its reconciliation software to automate the identification of discrepancies in financial data.

In February, Trintech announced a strategic partnership with SAP, integrating its reconciliation software with SAP’s financial management tools to enhance real-time reconciliation.

Access Complete Report: https://www.snsinsider.com/reports/reconciliation-software-market-2807

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Jagney Dave

SNS Insider Pvt. Ltd

+1 315-636-4242

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

Distribution channels: Technology

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release